Loan Management System

How Visartech helped to develop a loan management application that regulates the borrowing/lending money process between the closest people and beyond.

PayMyParents is a P2P lending and borrowing platform built out of a desire to financially educate children and regulate the money lending process between family members, friends, and particularly anyone.

Industry:Fintech

Location:Australia

Partnership since: 4 months

Featured on top Australian news TV shows and magazines

$2.3 million-worth loans processed within a year

The Brief

Loantech software as a solution to personal pains in finance that saves family relationships.

| The best inventions come from a particular need of people. Once recognized and implemented, the solution becomes truly popular as its founders got through it by themselves. That’s the case with PayMyParents loan tech application. Like most parents, the founders wanted to help their children financially. But, the money lending process was not regulated clearly. It became quickly obvious that children lack the needed knowledge about their responsibilities and the money lending process. |

The repayment procedure was hugely delayed and any reminders caused family disputes.

The founders realized the need for an online loan tech app that will be able to regulate the whole money lending process with the loan agreement and teach children good financial literacy. The reminder system allows for avoiding personal conflicts.

Over time, it was clear that such a loan management system can be useful in any relationship. So the loan tech app required a change in the business logic. The Visartech team helped to introduce the necessary improvements in the business model along with the concurrent solution infrastructure upgrade, frontend, and backend development.

Deep expertise in fintech software development allowed our team to easily propose the right solutions in tech stack choice and the whole loan tech app development process implementation.

Service Core

Precise execution of the lending platform development process.

Business Analysis

Infrastructure Update

Front-end Development

Back-end Development

Project Management

Quality Assurance

Challenges

How to shift a fintech software product to a new business model without interruptions.

The Visartech team has stepped into fintech solution development, not from the ground. The money lending platform was already launched and well tested by the founders and their families in the first place. Once the idea was proven to be in demand, the founders wanted to make it available for everyone.

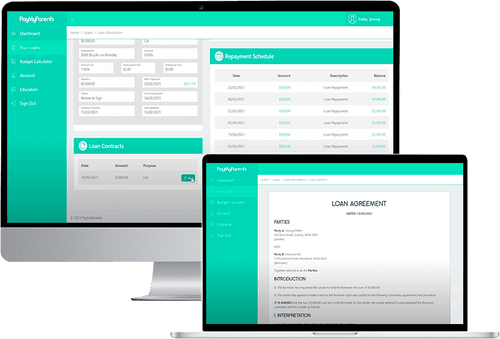

It required us to evaluate accurately the existing functionality for both the Borrower and Lender roles, get acquainted with the codebase, and propose the necessary improvements along with the clear step-by-step app development roadmap.

Among the most crucial challenges ahead of our app development team were:

- Introduce the business model change

Our business analysts needed to calculate all the details of shifting a loan tech software product to a new business model. In particular, from a system for parents and children solely, it should become a fully-functioning platform for lending money to anyone. No wonder, it required changes in the payments model as well.

|

The main challenge was to make the transition to the new business logic of the loan management platform. In doing so, we were obliged to ensure the system works stable, the user’s data stays safe and the user experience is even better than it was before.

A dedicated business analyst had to document the user flows and app user behaviors to make a clear vision of the expected result for both app developers and business owners.

There was a range of various challenges along the entire journey of fintech product development. Even so, Visartech specialists remained dedicated to the primary business goals that are reflected in solid loan management software.

Solutions

Smooth transition to a high-grade loantech software product with great user experience.

A bunch of technical changes was introduced by Visartech developers to implement the requirements of our clients while ensuring the safety of user data and consistency in user experience.

The key development solutions implemented by the Visartech experts are:

|

|

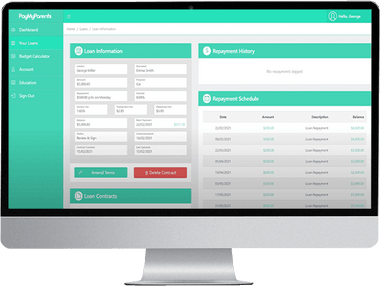

- App Interactivity

Our development team has implemented the best AJAX principles to enhance the loantech app responsiveness. It allows asynchronously sending and updating data parts in real-time. So when a user enters some data on a page, only the element in question changes, not the whole page.

- Database Testing

To make sure that the implemented changes have not interfered with the safety of users’ data, our quality assurance team has made thorough data testing.

Our development team has chosen React as the key technology for frontend development and .NET Core for backend development. It allows getting great performance and app interactivity. MySQL database with DB migrations helped us to preserve users’ data. AWS helped to update the loantech app infrastructure and add more flexibility to deployment and app functioning.

Sometimes we do not notice certain things, however, they deserve special attention. The main idea of the project shows how financial operations between people can become absolutely transparent and organized. It would be great if everyone could have such a responsible attitude to loans and financial relations within the family. Since I love planning myself, I enjoyed checking schedules out on this project, and not only looking for potential flaws, but also suggesting options for improvements.

The Result

PayMyParents becomes a full-fledged P2P lending platform.

| The Visartech development team has significantly improved the initial idea of a money lending solution for family members and turned it into a high-grade loan management software servicing any person. The improvement roadmap offered by the Visartech specialists has resulted in accelerated proceedings, enhanced app responsiveness, preserved user data, and an attractive user experience. |  |

Our fintech development expertise helped to create a loan tech app that gains traction in the Australian P2P lending market:

- The loan management system has been numerously featured on top Australian TV shows.

- The user base has grown by 35% within the first 3 months after the new app version launch.

- The lending app’s popularity continues to grow among families interested in expanding their children’s financial literacy.

With a $30 billion yearly capacity in family loans on the Australian market only, the P2P lending software strikes into the in-demand market uncovering the huge potential for business growth.

PayMyParents Today

- Featured

- On Top Australian media

- 1,400+

- Private lenders

- 2,3M+

- Loans processed within 1 year

- 2+

- Years of loantech experience