With digital transformation assuming a faster pace, loan management software is gaining wider adoption. Faster and more efficient than the legacy lending system, loan software is helping lenders to streamline and automate loan origination and processing. In this blog, we will provide a comprehensive overview of existing loan systems, and outline their advantages and approximate app development costs.

What is a Loan Management System?

A loan management system is a digital platform that helps automate every stage of the loan lifecycle, from application to closing. The traditional loan management process is meticulous, time-consuming, and requires collecting and verifying information about applicants, their trustworthiness, and their credibility. Further, the process involves calculating interest rates and supervising payments. A loan servicing software not only automates these procedures but also provides useful analytics and insights for lenders and borrowers.

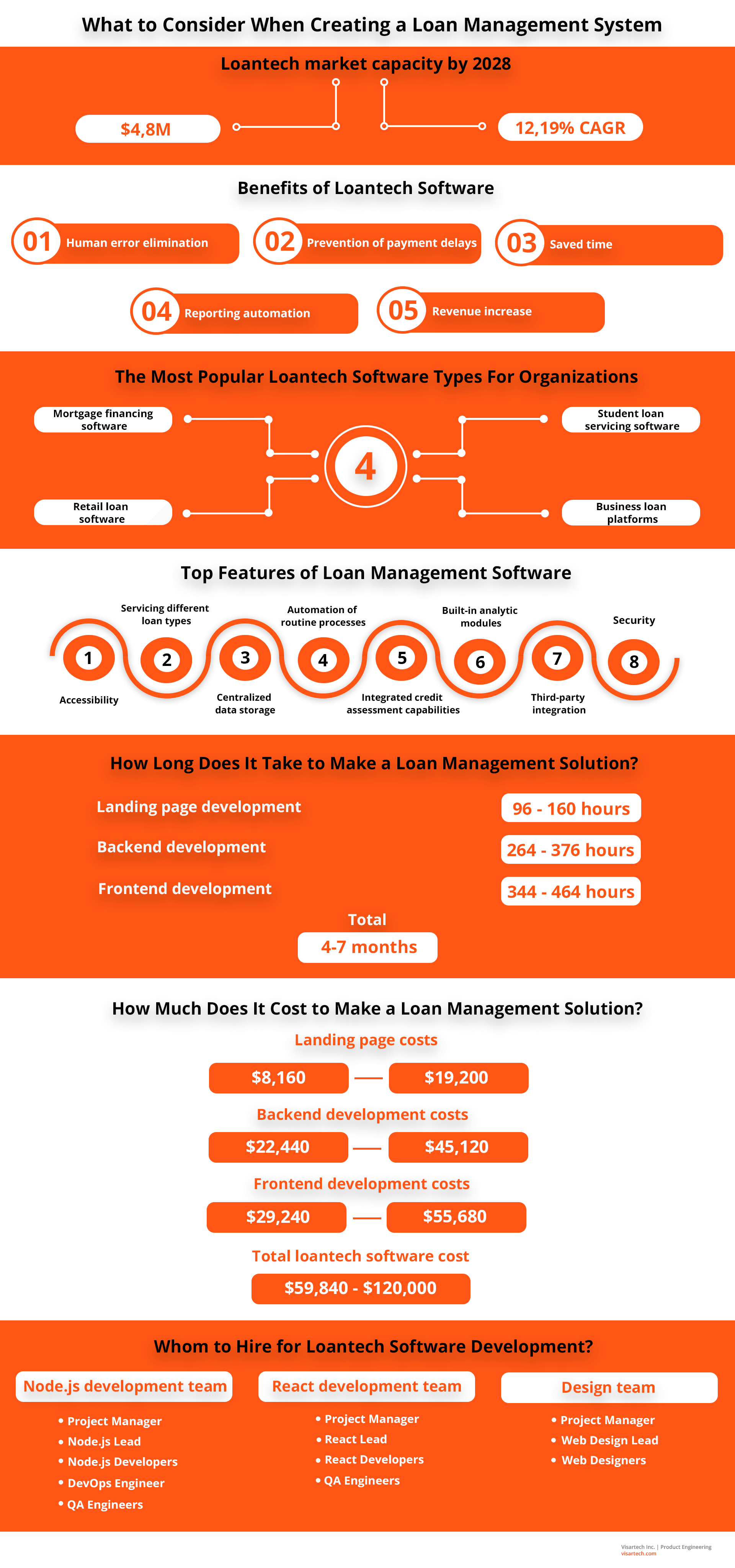

The stage for the growth of the lending software market has been set by the ongoing digitization of businesses, and stricter regulatory requirements forcing financial companies to build loantech software to handle growing workloads and meet regulatory challenges. The market for loantech is expected to reach $4,812 million by 2028 and is currently growing at a steady CAGR of 12,19%.

When it comes to loan software market share by region, North America is leaving other countries far behind. The staggering growth of the loan solution market in this world region is driven to a large extent by the state of the US mortgage market, now fully recovered from the crisis of 2007/8. With gross mortgage value reaching $74.8 billion in 2023, investing in mortgage app development makes perfect sense for lenders based in the United States.

The second-largest market share in loan software development belongs to the EU, where the GDPR law places high demands on data handling standards. In European regions not covered by GDPR, such as Eastern Europe, Russia, and Turkey, loan digitization has also assumed a faster pace.

How Loan Management Software Improves The Lending Experience

The process of loan assignment, calculation, and management is quite complex. As such, errors may occur at every stage: from wrongly accessing the credibility of a company or individual, to calculation and reporting. Moreover, the entire loan process involves the work of several employees and consumes a lot of effort. Failure to comply with numerous regulations not only leads to fines and restrictions but also has a negative impact on the company’s reputation. On top of that, the traditional lending process is deemed boring and tiresome by younger clients. As such, millennials and Gen Z are more attracted to companies willing to offer digital-only experiences.

Admittedly, smart lending software leveraging robotic process automation and big data is capable of coping with a lot of routine tasks faster than human employees, and with more accuracy.

The benefits of loantech servicing software for lenders include:

- Eliminating human error

It’s no secret, that calculations are something that algorithms handle better than we, humans. In a lending system, there are just too many variables, which is why it is error-prone. The best loan servicing software, however, is created to completely rule out any errors, which is, undoubtedly, beneficial from every standpoint.

- Preventing delays in payment

Not being able to collect a debt is something that most lenders are especially wary of. However, if they leverage a traditional loan management approach, they may not see it coming. Loan servicing systems, on the other hand, integrate analytic modules capable of detecting even the most subtle fluctuations in clients’ credibility and preventing payment delays in a timely manner.

- Saving time

Loan management requires a great level of meticulousness and attention to detail. As a rule, a full-fledged team is required to deal with every aspect of a loan process. Needless to say, loan management carried out manually and based on paperwork takes up a lot of time. A digital lending system, on the other hand, automates the routines and enables your team to dedicate time to other important tasks.

Read also: Use Trunk Based Development for Product Agility

Learn how to deliver a product in real-time easy and fast

- Automated reporting

Automated report generation is another invaluable feature offered by a digital loan servicing platform. Accounting, tax reports, and invoices are often requested by regulatory bodies, borrowers and investors. These high urgency reports should be provided on demand, and contain information, which is 100% accurate. Loan tracking software enables lenders to quickly generate reports of different types and submit them urgently, in the required formats.

- Increased revenue

This stems from all of the above: an automated loan processing system enables lenders to process more applications, assign and manage more loans, and see them all the way through closing all while detecting scams and preventing delays. The staff is free to oversee the process and focus on client relationships and look for new business opportunities. This enables financial companies to gain a distinct competitive edge and increase revenue.

Most Common Loan Types Managed by Loantech Apps

If you’re contemplating building a digital lending solution, it makes sense to find out about the existing types of loan servicing software for private lenders and large organizations.

All in all, loan management systems for large organizations available today fall into a number of categories:

All in all, loan management systems for large organizations available today fall into a number of categories:

1. Mortgage financing software

The mortgage apps are targeted to house buyers applying for loans. Free loan servicing software for mortgages is usually provided by established banks, although NBFOs may offer mortgage loans as well. There is also a category of apps simplifying the mortgage application process and refinancing mortgages.

2. Retail loan software

This loantech software is targeted at helping customers obtain loans for all kinds of purchases – from consumer electronics to cars and real estate. Credit cards and loans against property also fall into this category. Retail lending is, in essence, an umbrella term for all individual loan types.

3. Student loan servicing software

A vast segment of personal loan software is dedicated to student loans. This type of loan servicing software helps manage financial relationships between students and educational establishments and is perfect for a loantech app, calculation, tracking, reporting, and management.

4. Business loans

A business loan is used for loantech investments in a startup company, or in the business development of an existing one. Companies and entrepreneurs can get a business loan from banks, non-bank financial companies, and online lenders. There’s a segment of loan servicing software for private lenders dedicated to peer-to-peer lending as well.

In essence, loantech software for lenders falls into three main categories.

Loan Accounting Software

Loan management comprises several important steps, and a loan calculator is one of them. Estimating the amounts of down payments and regular payments can be tricky, and this is where loan accounting software can lend a helping hand.

Online Loan Application Software

There is also a segment of software dedicated solely to generating loantech apps. Applying for a loan requires collecting and submitting lots of documents and collateral materials for verification and credibility assessment. Online loan application software enables businesses and individuals to easily fill in and submit applications for originating loans and facilitates the verification process for financial organizations.

Loan Processing Systems

These are the systems automating and simplifying loan operations such as calculating interests, fees, and commissions, loan rescheduling, reimbursements, and repayments.

Needless to say, there are comprehensive loan management platforms combining the loantech app, calculation, and management capabilities.

Top Features of Loan Management Software

Let’s now explore the must-have features of loan management systems for lenders.

1. Accessibility

An organization looking to build loan software may not have enough on-premise infrastructure capacities to ensure its non-disruptive operation, updates, and support. Scaling during peak workloads and handling an increase in the number of users and subscriptions may also be quite challenging. Using cloud infrastructure is best to ensure optimal scalability and availability.

2. Servicing different loan types

The more types of loans your money lending software is capable of servicing, the better. Lending applications that have a wide range of use cases, will surely attract more users than apps targeting only one specific loan type. A loantech software to create loan app estimation, for example, may have a broad range of applications from student loan tech calculations to estimating business loans and mortgages.

3. Centralized data storage

Every stage of the lending process involves working with customer data. The best loan servicing software stores this data in centralized storage accessible during every loan processing stage. A legacy loan management system, on the other hand, uses a siloed approach to data storage, which makes loan processing more laborious and lengthy.

4. Integrated credit assessment capabilities

Modern loan servicing software for private lenders should be able to instantly connect with credit bureaus and any other bodies responsible for credibility assessment. Such platforms should receive regular credit data updates and leverage big data analytics to assess the trustworthiness of applicants. The client’s social media activity, for example, can be a valid source of alternative assessment of credibility.

5. Automation of routine processes

Using robotic process automation to streamline simple rule-based processes is another must-have feature of a loan management platform. Automation accelerates loan origination and processing and accounts for increasing client satisfaction. On top of that, it helps to avoid human error.

6. In-built analytic modules

Leveraging artificial intelligence (AI) and big data is another hallmark of excellent loan servicing software for lenders. Not only does it help to generate reports but also enables companies to evaluate market trends, detect patterns in customer behavior and come up with new products and offerings.

7. Third-party integration

Another feature that most organizations find especially attractive in a loan processing system, is its capability to integrate with other enterprise software. ERP and CRM solutions are capable of enriching the lending system with data and insights. Systems integrating lending modules with software for remote sales personnel are also enjoying high popularity among lenders.

Read also: Payment Gateway Integration: How to Implement It

Exploring essential features and steps to payment gateway integration

8. Security

Finance company software works with classified and highly sensitive data, and for both lenders and customers, security is a matter of paramount importance. An excellent lending system should possess advanced security capabilities, and ensure the highest level of customer, data, and network protection.

Read also: How to Save Money on a Web Project for Businesses

Learn how to select the best tech stack for your web application

Top 5 Loan Management Software

Surely, the description of features and capabilities would not be illustrative without concrete examples. Below are some of the top-rated loan management software solutions for your consideration.

#1. Borrow Money

Borrow Money is a personal small loan software aimed at providing payday loans – quick loans for covering emergency needs and purchases. The app is one of the top-rated personal loan solutions on Google Play and is fast, easy to use, and completely free. The testimonials are mostly positive, however, some users report a lack of transparency and little or no information about lenders.

#2. TurnKey Lender

Powered by AI and targeted at business lenders, this loantech app is truly turnkey software. The range of use cases is impressive: business loan origination, investor/borrower relations management, debt collection, and peer-to-peer lending to name a few. TurnKey lender has mostly positive testimonials; cloud deployment, accessibility, and easy setup seem to especially appeal to users. The cons include a lack of out-of-the-box integrations with accounting software, limited reporting options, and some tech support issues (slow response).

#3. Rocket Mortgage

Rocket Mortgage is a solution for originating mortgage loans. This app enables customers to apply for home loans online, and have instant access to all of their loan documents and tax forms. This loantech software has a lot of positive testimonials and works on most devices and platforms. Some bugs have been reported, but the loantech company claims to have taken measures to prevent them.

#4. AES Student Loans

As the name implies, this app is for student loans. The digital loan solution is targeted specifically at managing tuition loans, acсessing documents, scheduling payments, checking balances, and creating loan repayment plans. The loantech app has been rated 4/7 on the App store, and the loantech reviews are mostly positive. All errors and malfunctions have been eliminated in 2020, according to testimonials, however, the app is available for iOS users only.

#5. PayMyParents

At Visartech, we have used our loan application development expertise in loan software development to build a personal loan management platform for transferring money between friends and family members. PayMyParents is easy to use, has an attractive interface, and enables users to easily track their money transfers. This peer-to-peer lending app received broad media coverage in Australia.

How to Select a Loan Management Software

Navigating among a plethora of loan management solutions can be a tricky task. However, there are a few guidelines companies should follow when selecting the software for loan management.

Your Business Requirements

The needs of SMB companies are inherently different from those of established enterprises. When selecting a loan management solution or thinking about bespoke loan software development, consider the type of your business and the current business goals. For example, some companies will prioritize loan diversity and base their decision on the variety of use cases and loan types. Others will go for a wide range of loan repayment options or versatile customization opportunities.

User Requirements

Further, you will strike a balance between a company strategy and the needs of your users. It is especially important to consider the needs of every group of users and stakeholders inside your company. This will give you solid info to fall back on when selecting the software for loan management.

Accessibility & Availability

Knowing the needs of your customers will help you decide on the way you want your loantech software to be deployed and delivered. The SaaS model is currently the most frequent choice since it enables companies to use cloud infrastructure resources to power application backend and ensure optimal performance. Also, think about making your loantech app accessible from a wide range of mobile devices and operating systems.

How Much Does It Cost to Make a Loan Management Solution

Surely, in many cases, out-of-the-box solutions won’t apply, so you may be faced with the question of creating your own application for loan management. If you plan to develop your solution in-house, the overall cost will include hiring and onboarding employees with relevant expertise and the cost of development tools and infrastructure resources. Admittedly, the expenses will be heavier than in the case of hiring a product development agency, but this approach may be justified if you want to keep all the expertise in-house and plan on developing more financing software as part of your business strategy.

In other cases, it makes sense to partner with a reputable software development company to power your development company. The loan application development costs will start at around $40,000 (check more details below), but will ultimately depend upon the complexity of the loan management solution that you plan to develop.

Just to be precise, our business analysts have estimated the loan management product containing the basic functionality.

First, let’s think about what major app development parts go into such software development. In general, it includes:

- landing page development,

- frontend development,

- backend development.

Various engineering teams are responsible for the implementation of these app development stages: the design team, React team, and Node.js development team. The distribution depends on the core technology stack utilized for the app development.

What Is the Structure of the Involved App Development Teams?

The backend part of app development is like creating the brain of a loan application. So it requires solid technology specifically for this responsible task.

Node.js is a perfect JavaScript run-time environment for this purpose.

The structure of a Node.js development team includes:

- Project Manager

- Node.js Lead

- Node.js Developers

- DevOps Engineer

- Quality Assurance Engineers

To develop the landing page and the frontend part of a loan application, the best option is to involve the Design team and the React team.

The design team is responsible for the appearance, layout, and possibly content of the website of an app. React is a JavaScript library for building user interfaces that implements the design results into the website or an app.

The structure of a design team includes:

- Project Manager

- Web Design Lead

- Web Designers

The structure of a React development team includes:

- Project Manager

- React Lead

- React Developers

- Quality Assurance Engineers

Each specialist contributes to the overall appearance, stability, and performance of a loan management app.

Now let’s see what goes into the loan application cost starting from how the app will look to the way it functions.

Landing Page Development for a Loan Application

The primary focus while presenting the loantech financial services lies in creating a landing page that will outline the details of the lending services and distinguish all crucial conditions for getting a loan to customers.

Here is what goes into the landing page development.

| Tasks/Features | Optimistic, days | Pessimistic, days |

| UX/UI design | 5 | 7 |

| Website development | 5 | 10 |

| Deployment | 2 | 3 |

| Total | 12 | 20 |

If you take 8 hours that a working day consists of, the landing page time in hours would be from 96 to 160 development hours.

Backend Development Cost of a Loan Application

The backend part is the main part of a loantech app that drives its core functionality and helps people to actually receive loans automatically which also includes getting through verification, gathering the necessary documents, etc.

Below we’re gonna show you the rough estimation of the minimum and maximum amount of time required for the backend development of a loan management application.

| Tasks/Features | Optimistic, days | Pessimistic, days |

| Infrastructure setup | 4 | 6 |

| CI/CD | 3 | 4 |

| Authentication | 4 | 6 |

| User logic | 5 | 7 |

| Loans logic | 6 | 8 |

| Agreements logic | 4 | 6 |

| Synchronization with selected banks | 7 | 10 |

| Total | 33 | 47 |

The total app development hours required for the backend development of a loan management application range from 264 to 376.

Frontend Development Cost of a Loan Application

The same approach in estimation relates to the frontend development of a loan management app.

| Tasks/Features | Optimistic, days | Pessimistic, days |

| UX/UI design | 10 | 12 |

| Sign in/sign up | 4 | 5 |

| Main loantech dashboard | 4 | 6 |

| Loan creation | 3 | 4 |

| Smart contracts | 4 | 6 |

| Bank information | 3 | 4 |

| Loans management | 5 | 7 |

| User profile | 3 | 4 |

| Notifications | 2 | 3 |

| CI/CD | 3 | 4 |

| Deployment | 2 | 3 |

| Total | 43 | 58 |

Translating it into the working hours, the required time for the frontend development ranges from 344 to 464 development hours.

The average app development hourly rates of various software development companies worldwide range from $50 to $120.

So, if we multiply the rough estimation, made by our business analysts, by the global app development hourly rates, we will receive the following loan application price range:

- Landing page costs from $8,160 to $19,200.

- The loantech app backend development costs from $22,440 to $45,120.

- The loantech app frontend development costs from $29,240 to $55,680.

So, how much does a loan application cost?

You can already guess that the total loan management app development cost will take from $59,840 to $120,000 in USD currency.

As for the total app development time, it may take around 4-7 months with the development of the aforementioned functionality.

By the way, loan applications are not only used in the financial sphere but ultimately become a widespread way to help users receive the loantech financial services of any company much faster due to internal loan programs for the clients. The automated process of giving such a solution to your clients may greatly speed up your company’s growth in terms of a growing customer base and greater customer loyalty.

When you trust your clients, they trust you!

Wrapping Up On Loantech Development

The requirements that the market currently places on loan products are quite high: quick loan application processing, flexibility, scalability, enhanced security, and regulatory compliance. A good loan management system, however, can is capable of handling these demands and helping companies reach their objectives.

At Visartech we are proficient at creating solutions for banking and fintech, including the system for loan servicing and management.

Looking for a tech partner to bring your ideas to life? Contact us now for a free consultation!